Finance

One month in…

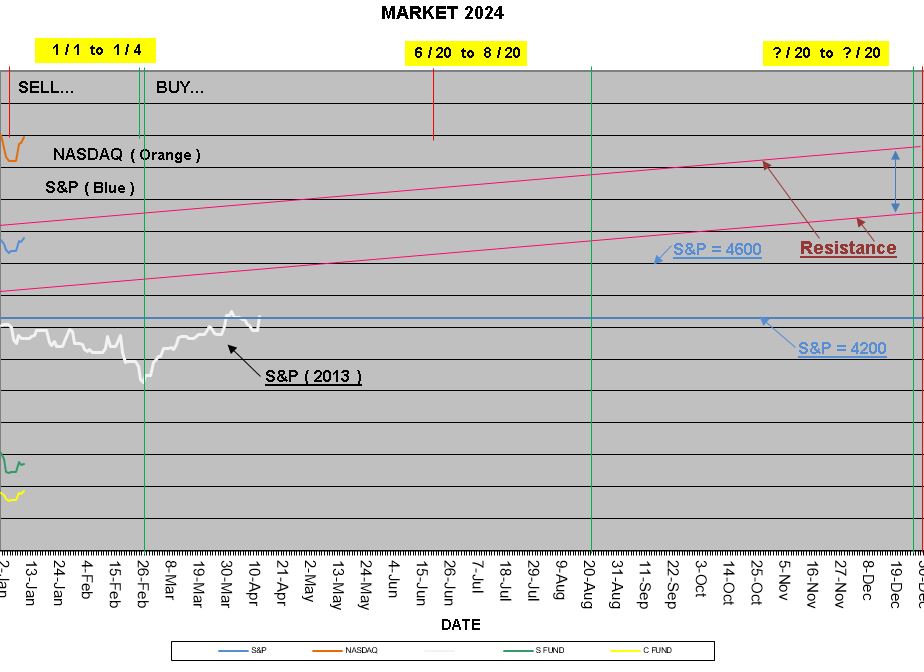

Following 2013 Market S&P results (based on amount of liquidity added to the Market in 2009 & now 2020…

The chart above shows the S&P & its current performance this year… (updated 13 JAN 2024 )

NOTE: MARKET was sideways in 2013, so patience is important ( buy low — sell high )

NAILED THE LOWS… One month lag on the HIGHs

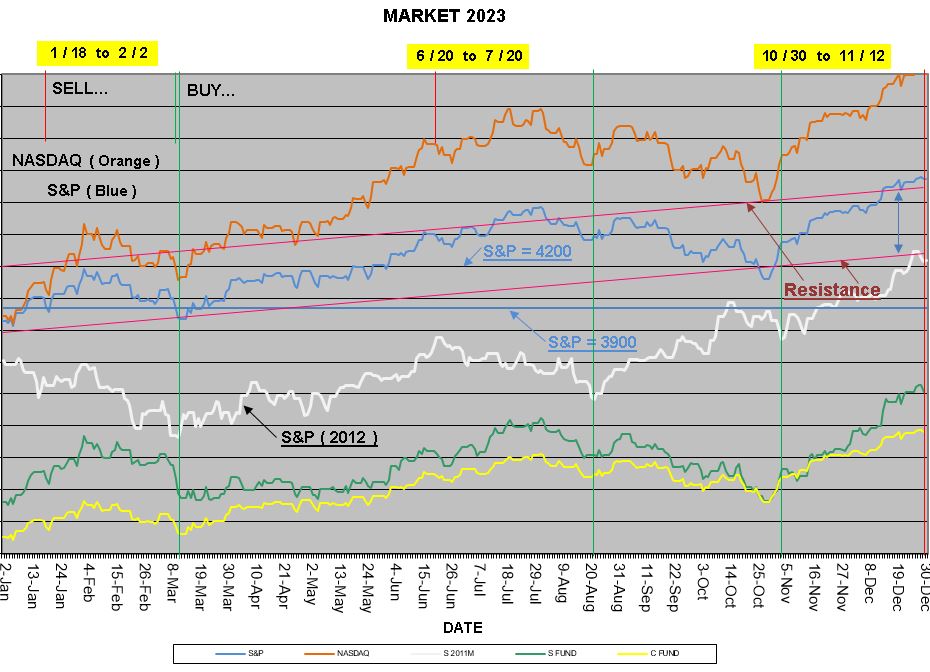

Following 2012 Market S&P results (based on amount of liquidity added to the Market in 2009 & now 2020…

NOTE: Liquidity is being removed, so after August is questionable…

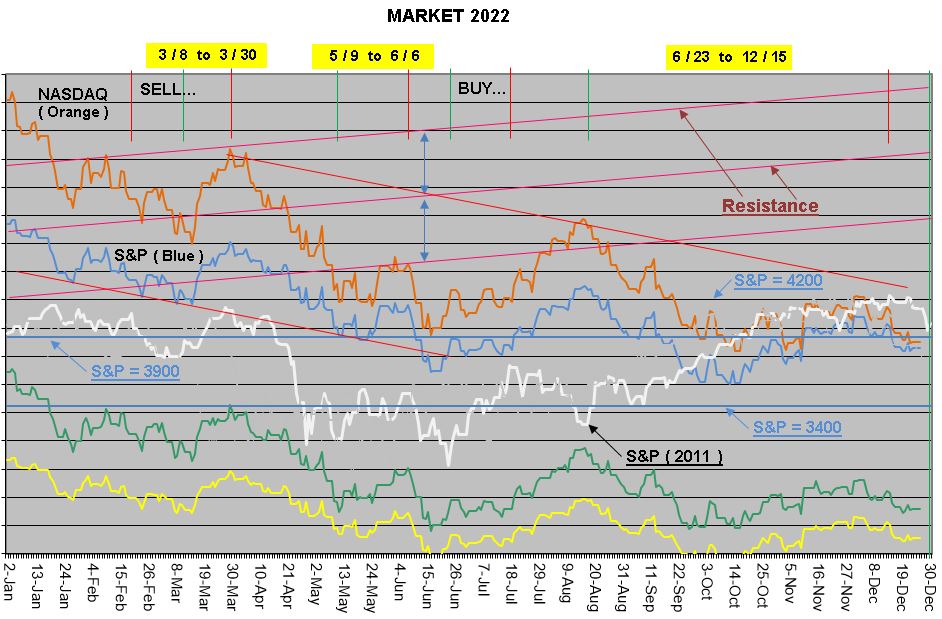

Following 2011 Market S&P results (based on amount of liquidity added to the Market in 2009 & now 2020…

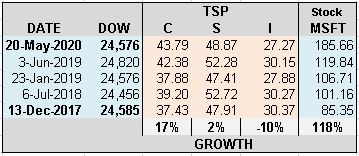

The Table (below) shows how the Equity (stock) Market exponentially out-performs when compared to TSP or 401K plans ( before & after MARKET meltdown ).

CLICK here for calendar info…

? Economic Cyclical Chart

shows where to allocate all or part of your money by date

( up 31.4% in year 2021…).

( up 2.4% in year 2022…).

Say you had $300K in the TSP “S” fund (or 401K) in Sept 2018. By Christmas 2018, you had only $226K ( –24.7% ).

To get even, you needed a % gain greater than the % lost ( +32.9% ).

By FEB 2020, you had $325K ( +43.9% ). You may think you made $100K in 2019, but that’s because you didn’t track your lost from 2018…

By MAR 6 2020, you have only $277K ( –14.8% ). And are now down in the last 18 months…

The Good News… With 5% contributions of $100K salary & 4% Agency match from Sept 2018, you have your additional contribution ($7.6K) plus 96% of Agency match (a gain of $6K in 18 months). So, adjusted balance $283K ( –13.0% ).

MEANWHILE: despite no matching agency funds, if you had $300K in Microsoft stock in Sept 2018. You would now have $447K today (down from $522K in FEB). A gain of ( +32.9% ).

That’s why 401K aren’t that great in an economy with unregulated capitalism. By retirement, greed & inflation will kick your butt…

UPDATE: By Sept 7 2020, you have only $320K ( +7% ) in your TSP now (not much to show for the last 24 months)…

You would now have $585K ( +95% ) today ( in Microsoft stock )…

? Recommended Stocks

shows my picks.

OTHER CHARTS:

? Recessions by Political Parties

? Market Performance by President

If you want to open a Stock Market Trading Account:

Under $5,000, then join.Robinhood.com/George815

Over $5,000 & plan to add more, then TDameritrade.com and I can send you a referral.